This article delves deep into the cost management of casting processes within the machinery industry. It analyzes the composition of casting process manufacturing costs, compares the advantages and disadvantages of standard cost method and actual cost method, and proposes new ideas and methods for cost management. By introducing advanced cost – management tools and systems, such as cost – model – based software, batch cost management, and MES systems, casting enterprises can achieve more accurate and flexible cost control, thereby enhancing their competitiveness in the market.

1. Introduction

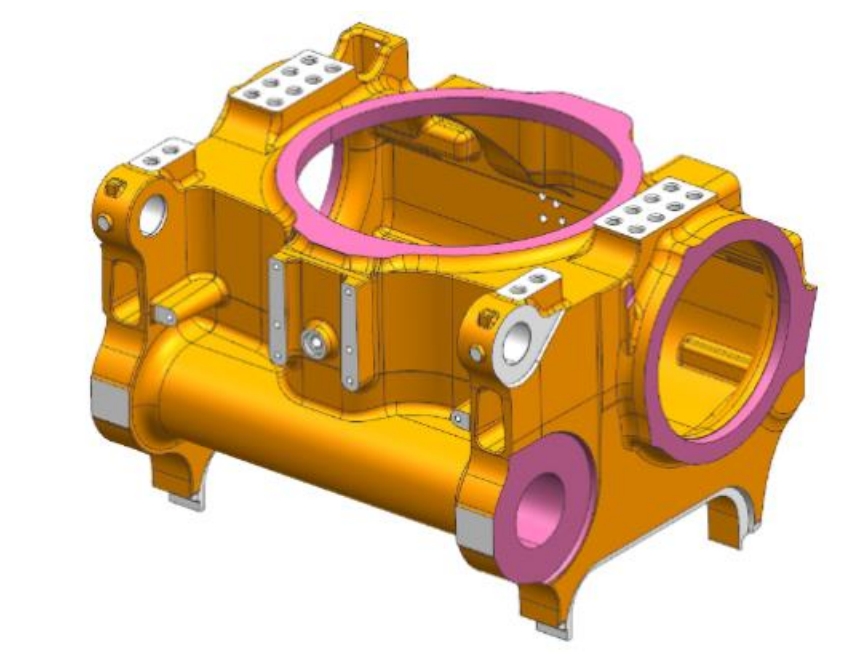

In the heavy machinery industry, casting processes play a crucial role. Components like gearbox housings, drive axle housings, engine blocks, and chassis parts are often produced through casting. The quality and cost of these castings directly affect the performance and price competitiveness of the entire machine. However, due to the complexity of casting processes, the diversity of raw materials, and the variability of process parameters, accurately calculating the cost of castings has always been a significant challenge in the industry.

1.1 The Importance of Casting Processes in Heavy Machinery Manufacturing

Heavy machinery needs to withstand high – strength loads and harsh working environments. Casting is the preferred method for producing components with high – strength and high – wear – resistance requirements. Castings can meet complex shape and size requirements through different material formulations and process designs. For example, in the manufacturing of loaders and excavators, the casting quality of key components determines the overall performance and service life of the equipment.

1.2 Challenges in Casting Cost Management

- Cost Estimation Inaccuracy: The cost of raw materials accounts for a large proportion of the total cost of castings. Fluctuations in raw material market prices directly affect cost estimation accuracy. Different material formula combinations lead to different performance and cost manifestations, and it is difficult to optimize management. In addition, process parameters in the casting process affect product quality and cost. Unstable parameter control may result in product quality fluctuations, additional rework, and material waste, increasing cost differences.

- Difficulties in Energy Consumption Estimation: The energy consumption in the casting process is difficult to accurately predict. The casting process requires a large amount of manual labor, especially in the multi – variety, small – batch production mode, where labor costs increase significantly.

- Impact of Management Efficiency: The management efficiency of casting enterprises also has a non – negligible impact on costs. Ineffective management may lead to waste of resources and increased costs.

1.3 The Significance of Cost Management in Casting Enterprises

Accurate cost estimation can help casting enterprises improve their profitability and enhance their competitiveness in the market. By analyzing and optimizing cost factors in the casting process, enterprises can achieve more precise process control and resource allocation, thereby improving production efficiency, reducing material waste, and energy consumption.

2. Composition of Casting Process Manufacturing Costs

Casting process costs in the heavy machinery industry consist of material formula costs and process – related costs. Understanding these cost components is the basis for accurate cost management.

2.1 Composition of Casting Material Formula Costs

- Taking the Loader Axle Housing as an Example: When using ZG270 – 500 material for sand – casting, the material formula cost has the following components.

- Raw Material Costs: The raw material formula of ZG270 – 500 usually includes elements such as carbon (C), manganese (Mn), silicon (Si), phosphorus (P), sulfur (S), chromium (Cr), and molybdenum (Mo). The proportion of these elements affects the performance of the casting. The cost of carbon – steel – based materials (including basic elements such as carbon, manganese, and silicon) accounts for 60% – 70% of the total raw material cost. Chromium accounts for 5% – 10%, molybdenum accounts for 2% – 5%, sulfur and phosphorus are controlled within a low range to ensure material performance, and impurity control and other alloy additives account for 1% – 3%. Raw material market prices fluctuate greatly, and raw material costs account for about 30% – 40% of the total casting cost. Therefore, controlling raw material procurement costs is of great significance for cost management.

- Material Losses: Material losses in the casting process include melting losses and processing losses. Usually, melting losses account for 2% – 5% of the total raw material volume, and processing losses (such as deburring and trimming) account for 1% – 3%. Optimizing the melting process and processing flow can reduce loss costs and improve material utilization.

- Auxiliary Material Costs: Auxiliary materials include deoxidizers, desulfurizers, and slag – formers used in melting. Although these auxiliary materials account for a small proportion in the material formula cost, they have an important impact on the final quality of the casting.

- Energy Consumption Costs: Melting requires a large amount of electricity or gas. Energy consumption costs account for 10% – 20% of the material formula cost. Different melting temperatures, times, and efficiencies directly affect energy consumption costs.

| Classification | Cost Proportion |

|---|---|

| Carbon – steel – based materials | 60% – 70% |

| Chromium | 5% – 10% |

| Molybdenum | 2% – 5% |

| Sulfur and phosphorus (controlled) | – |

| Impurity control and other alloy additives | 1% – 3% |

| Material losses (melting) | 2% – 5% |

| Material losses (processing) | 1% – 3% |

| Auxiliary material costs | Small proportion |

| Energy consumption costs | 10% – 20% |

2.2 Composition of Casting Process – Related Costs

- Taking the Sand – Casting of Loader Axle Housing as an Example: The process – related costs are composed of multiple links.

- Mold Manufacturing Costs: The casting of the axle housing usually requires sand molds and core molds. Mold manufacturing costs include mold materials (such as sand and binders), mold processing fees, and mold maintenance fees. The material cost of sand molds accounts for about 5% – 10% of the total casting cost, of which the sand material cost is 3% – 5%, and the cost of binders and other additives is 2% – 5%. The labor and equipment – use costs for mold manufacturing should also be included in the total cost, accounting for 5% – 8% of the process – related costs.

- Melting Costs: Melting is a key link in the casting process. The cost mainly includes the melting cost of raw materials and the use cost of melting equipment. Melting requires high – temperature electric furnaces or induction furnaces, and the energy consumption and equipment depreciation during melting are the main cost sources. Melting energy consumption usually accounts for 15% – 20% of the process – related costs.

- Pouring and Cooling Costs: After melting, the molten metal is poured into the sand mold. The labor and equipment – use costs during the pouring process account for 10% – 15% of the total process cost. The length of the cooling time affects the production rhythm of the workshop and the quality of the casting. Optimizing the cooling process can reduce energy consumption costs and improve production efficiency.

- Cleaning and Post – processing Costs: After the casting cools, it needs to be cleaned and post – processed, such as deburring, grinding, and heat treatment. The costs of these links mainly include labor, equipment – use, and consumable costs, accounting for 10% – 15% of the process – related costs. For example, the energy consumption of heat treatment is relatively large, especially for large – scale castings that require long – time high – temperature treatment, so the heat – treatment cost accounts for a large proportion in the total post – processing cost.

- Quality Inspection and Rework Costs: The quality inspection of axle – housing castings involves non – destructive testing (such as X – ray and ultrasonic) and surface inspection. The costs of testing equipment, consumables, and labor account for 5% – 10% of the process – related costs. If defects are found during the inspection, rework or waste treatment is required, and this part of the cost usually accounts for 3% – 5% of the casting process cost.

- Labor and Management Costs: The labor costs in the casting process include the wages of operators at all levels and the expenses of managers. Labor and management costs account for about 10% – 20% of the total process – related costs.

- Equipment Depreciation and Maintenance Costs: Large – scale equipment in the casting workshop (such as melting furnaces, pouring machines, and cleaning equipment) needs to be included in the depreciation cost. The daily maintenance and repair of equipment are also necessary cost expenditures, accounting for about 5% – 8% of the process – related costs.

| Process Link | Cost Proportion |

|---|---|

| Mold manufacturing (material – sand) | 3% – 5% |

| Mold manufacturing (material – binder) | 2% – 5% |

| Mold manufacturing (labor and equipment) | 5% – 8% |

| Melting (energy consumption) | 15% – 20% |

| Pouring and cooling | 10% – 15% |

| Cleaning and post – processing | 10% – 15% |

| Quality inspection and rework | 5% – 10% |

| Labor and management | 10% – 20% |

| Equipment depreciation and maintenance | 5% – 8% |

2.3 Case Analysis of Axle Housing Sand – Casting Costs

Taking the sand – casting of a certain loader axle housing as an example, the total manufacturing cost of ZG270 – 500 can be roughly divided into material formula costs and process – related costs.

| Project | Classification | Cost Proportion | Subtotal | Total |

|---|---|---|---|---|

| Material formula costs | Raw materials | 35% | 57% | 100% |

| Material losses | 3% | |||

| Auxiliary materials | 2% | |||

| Energy consumption | 9% | |||

| Process – related costs | Mold manufacturing | 11% | 43% | |

| Melting | 9% | |||

| Pouring and cooling | 7% | |||

| Cleaning and post – processing | 7% | |||

| Quality inspection and rework | 6% | |||

| Labor and management | 8% | |||

| Other | 5% |

Through the above analysis, we can understand the specific composition of casting process costs and their distribution in the sand – casting of loader axle housings. This helps to identify the key points of cost control and formulate effective improvement measures. Currently, most of the data on the composition of casting process costs are derived from a large amount of historical costs or empirical values, and the use of manual or spreadsheet calculation methods makes it difficult to refine the data granularity.

3. Analysis of the Advantages and Disadvantages of Casting Cost Management Methods

In the heavy – machinery casting industry, the standard cost method is mainly used for cost accounting, and some enterprises also use the actual cost method. Each of these two cost – management methods has its own advantages and disadvantages, and there are differences in the accuracy and controllability of casting costs.

3.1 Advantages and Disadvantages of the Standard Cost Method

- The Concept of the Standard Cost Method: The standard cost method is a cost – accounting method based on pre – set standards. For a specific type of casting, the standard amount and price of pig iron per ton, the standard labor hours and wage rate, and the standard manufacturing – expense allocation rate are determined in advance. At the end of the month, the actual cost is compared with the standard cost, and the differences are analyzed.

- Advantages of the Standard Cost Method

- Convenient for Budget and Plan Management: The setting of the standard cost method is based on historical data and experience, which can help enterprises make long – term plans in production planning and budget management and is conducive to enterprises achieving cost – control goals.

- Simplify the Cost – Accounting Process: This method is relatively simple in accounting operations, reducing complex cost – allocation and collection work, and is suitable for application in a relatively stable production environment.

- Easy for Performance Evaluation: By comparing with the actual cost, enterprises can quickly discover differences in the production process and take measures to adjust. The standard cost method has high application value in production – efficiency and cost – difference analysis.

- Disadvantages of the Standard Cost Method

- Lagging Reflection of Actual Costs: The casting production process is affected by many factors. The standard cost method can only reflect these cost changes after the monthly settlement. The management granularity of the standard cost is not fine enough, and it is difficult to analyze the causes of differences.

- Inaccurate Allocation of Indirect Costs: In the standard cost method, indirect costs are usually allocated based on the company as a whole, and it is difficult to accurately assign them to specific parts or process links. This leads to insufficient accuracy in cost accounting and makes it impossible for enterprises to clarify the actual manufacturing cost of each part.

- Ignoring Cost Differences in Small – Batch and Multi – Variety Production: The casting industry often faces small – batch and multi – variety production modes, while the standard cost method is more suitable for large – batch and single – variety production environments. In small – batch production, the set standard cost often has a large gap from the actual cost and cannot accurately reflect the individual cost characteristics of different parts.

3.2 Advantages and Disadvantages of the Actual Cost Method

- The Concept of the Actual Cost Method: The actual cost method is based on the actual costs incurred, and the costs generated in the production process are collected and allocated monthly. This method directly reflects various cost fluctuations in actual production. For example, in the casting process, the actual cost management records the actual purchase price of pig iron, the actual working hours of workers, and the actual power consumption. The actual cost method includes three types: the variety method, the step – by – step method, and the batch method (order method). Casting enterprises generally use the batch method and the step – by – step method. The production of engineering – machinery axles and housings is a multi – step production process, so the step – by – step cost – accounting method is suitable for this production process. The step – by – step method is neither completely based on product – type accounting nor completely based on specification or batch accounting. It can combine these accounting methods to a certain extent and has its own uniqueness.

- Advantages of the Step – by – Step Method

- Accurately Reflect Actual Cost Expenditure: It truly reflects the actual cost situation of enterprises in the casting production process, provides accurate cost data for enterprises, and helps enterprises understand actual operating costs.

- Beneficial for Cost – Difference Analysis and Improvement: The step – by – step method collects and allocates costs according to production steps. By analyzing the costs of each production step, it reflects the cost changes of different – specification products and provides a more accurate basis for process improvement and cost control.

- Suitable for Large – Batch and Multi – Step Production: It collects and allocates production costs according to production steps and calculates the total cost and unit cost of semi – finished products and final products at each step.

- Disadvantages of the Step – by – Step Method

- Heavy Accounting Workload: It requires detailed recording, collection, and allocation of the costs of each process step in the production process. The calculation process is complex, the accounting cycle is long, the accounting workload is large, and the management cost increases.

- Lagging Cost Reflection: Since it is post – event accounting, it is difficult to conduct cost control during the production process in a timely manner, and it is difficult to take measures to control costs in a timely manner, which is not conducive to cost reduction.

- Not Conducive to Assessment and Incentive: It is difficult to clarify the cost responsibilities of various departments and employees, which is not conducive to their assessment and incentive.

3.3 Cost – Difference Analysis between the Standard Cost Method and the Actual Cost Method

- Differences in Cost – Management Objectives: The standard cost method aims to optimize production to achieve the standard cost, which helps enterprises improve the accuracy and efficiency of cost management. The actual cost method aims to truly reflect the actual cost expenditure situation and focuses on the authenticity and reliability of costs.

- Differences in Cost – Control Strategies: The standard cost method is more suitable for long – term cost control and budget management, while the actual cost method is more suitable for short – term cost analysis and immediate improvement.

- Differences in Cost – Management Requirements: The standard cost management pays more attention to the accuracy of cost control and the reliability of decision – making support, requires a high level of informatization, and needs a complete system integration and powerful data – analysis functions. The actual cost management emphasizes the authenticity and flexibility of cost accounting and has high requirements for data real – time – ness and cost – monitoring and early – warning functions.

3.4 Problems and Requirements in Cost Management

From the perspective of the development of cost – management ideas, the actual cost method belongs to cost – accounting management and has the characteristic of post – event reflection. The standard cost method belongs to cost – saving and control management and has the characteristic of in – process control. The emergence of the standard cost method is to solve some problems of the actual cost method. Therefore, if conditions permit, casting enterprises are recommended to use the standard cost method. When casting enterprises conduct cost management, they face the following main problems and requirements:

- Lack of Flexible Cost – Control Mechanisms: The lag in monthly – settlement difference feedback makes enterprises lack flexible cost – control mechanisms when facing rapid market changes and process adjustments. They cannot quickly adapt to market and technological changes. Comprehensive cost management requires a target cost or real – time predicted cost.

- Complex Cost – Difference Responsibilities: In an environment of expanding enterprise scale, complex management, and declining average profits, the changeable real – world conditions make cost – difference responsibilities complex. Functional management and behavioral – science management require clear responsibilities.

4. New Ideas and Methods for Casting Process Cost Management

With the progress of manufacturing technology and the improvement of informatization levels, casting enterprises need to introduce new ideas and methods in cost management to better cope with market competition and production – cost fluctuations. Drawing on the experience of advanced foreign enterprises, new methods based on information systems and modern cost – management tools can be adopted to improve the accuracy and flexibility of cost accounting.

4.1 Application of Software Based on Cost Models

The success of innovative cost – reduction strategies such as lean manufacturing is inseparable from accurate manufacturing – cost estimation. Advanced enterprises widely use software tools based on cost models in casting – cost management, such as the aPriori software.

- Application Method of the aPriori Cost Model

- Cost – Model Establishment: The aPriori software analyzes different materials, process parameters, and production conditions to establish refined casting – cost models. These models include material costs, process – related costs, equipment – use costs, and labor costs, providing enterprises with detailed cost structures and breakdowns.

- Real – Time Cost Calculation and Simulation: The aPriori software can predict the cost of castings during the product – design stage. By simulating real – time cost changes in the production process, enterprises can adjust and optimize the standard cost before production. This method not only improves the accuracy of cost accounting but also reduces cost deviations during the production process.

- Flexible Response to Different Batches and Varieties of Production: For small – batch and multi – variety casting production, the aPriori software can conduct independent cost analyses for different batches and parts, as well as for different material formulas. It helps enterprises identify the specific cost – driving factors of each part and provides improvement suggestions.

- Increasing Cost Transparency and Controllability: Through accurate cost modeling and real – time analysis, enterprises can have a clearer understanding of the costs of each production link. This transparency enables enterprises to adjust strategies in a timely manner during the production process, improving the flexibility and responsiveness of cost management.

- Casting aPriori Cost Prediction

In a selected virtual digital factory, by importing the 3D model information of a certain axle housing, the aPriori system automatically simulates the processing process and quickly generates the estimated cost and detailed cost breakdown of the part. When the material – formula selection or production – batch value changes, the corresponding cost also changes. - Actual Application Cases of aPriori

Some foreign casting enterprises have introduced the aPriori software. Through real – time cost calculation and simulation based on detailed cost models, they have optimized the methods for establishing standard costs and enhanced the level of refined cost management, achieving the following results:- Reducing Cost – Accounting Deviations by 30%: Accurate cost modeling has reduced cost deviations caused by manual estimation.

- Shortening the Product – Development Cycle by 15%: Since cost analysis and optimization can be carried out during the design stage, enterprises have achieved a faster response speed in product development and batch adjustments.

| Performance Indicator | Improvement Effect |

|---|---|

| Cost – accounting deviation reduction | 30% |

| Product – development cycle shortening | 15% |

4.2 Batch Cost Management

In the casting process, batch management and batch – cost analysis are important means of optimizing cost management, especially in the multi – variety, small – batch production mode. Batch – cost management can effectively improve the accuracy of cost control. The batch management of materials can be achieved by introducing a Warehouse Management System (WMS) to realize the informatization of warehousing management and help enterprises improve warehouse – operation efficiency.

- Concept and Implementation of Batch – Cost Management

- Cost Collection and Analysis: Batch – cost management involves collecting and analyzing costs on a production – batch basis. This method can accurately track the cost differences of each batch, helping enterprises adjust process parameters for different batches and optimize cost control. For example, in the casting of a certain batch of axle housings, if the material loss is higher than the standard, it may be due to inaccurate batching or improper pouring processes. By separately collecting and recording material costs, process costs, and labor costs for each batch and analyzing the cost differences, the main reasons for cost fluctuations can be identified.

- Cost Comparison and Optimization among Batches: By comparing the costs of different batches, enterprises can find the optimal production batch and apply the relevant experience to subsequent batch production. For instance, if a certain batch has a high mold – service life and a high product – yield rate, the mold materials and design of this batch can be analyzed for promotion in other batches.

- Adapting to Order Diversity: Batch – cost management is particularly effective in dealing with diverse orders. Enterprises can conduct independent cost analyses according to the characteristics of different orders and adjust process parameters, production rhythms, and personnel configurations to ensure the flexibility of cost management.

- Design of Casting Batch Management

Materials can be divided into batches according to suppliers, material types, and time. Molten – iron batches can be distinguished according to material batches, other auxiliary materials, and months. Casting batches can be differentiated according to molten – iron batches, cores, sand molds, and months. - Actual Application Effects of Batch – Cost Management

In some foreign casting enterprises, batch – cost records have facilitated more accurate cost – difference analysis. Through batch – cost management, the following effects have been achieved:- Reducing Material Waste by 10%: By comparing the material costs collected by batch, the reasons for high – waste batches can be identified and improved.

- Increasing Equipment Utilization by 5%: Batch analysis reveals the equipment – use situation in different batches, helping enterprises optimize equipment scheduling and improve production efficiency.

| Performance Indicator | Improvement Effect |

|---|---|

| Material – waste reduction | 10% |

| Equipment – utilization increase | 5% |

4.3 On – Site Data – Based Cost Calculation Using the MES System

Modern casting enterprises are gradually introducing the Manufacturing Execution System (MES) in cost management to achieve real – time cost calculation and control. The MES is a management system oriented to workshop production, which plays a role in transmitting information to optimize production activities. The MES realizes refined on – site cost – dynamic management through the automatic collection and analysis of on – site data.

- Cost – Calculation Method of the MES

- Real – Time Data Collection: The MES can automatically collect production data from all links in the casting process, including melting time, pouring temperature, cooling time, equipment utilization, and labor input. These data provide an accurate basis for cost accounting.

- Dynamic Cost Accounting: The MES can perform dynamic cost calculations based on the real – time collected data. For example, it can automatically calculate the actual cost of current production according to the material consumption, equipment operation time, and energy – consumption situation. This real – time cost accounting enables enterprises to detect cost deviations during the production process and take immediate measures to adjust, thereby reducing unnecessary cost expenditures.

- Combining Process Optimization with Cost Analysis: The MES can also combine cost accounting with process optimization. By analyzing the costs of different production links, it helps enterprises identify the weak links in the process. For example, if the energy consumption of a certain link is continuously higher than expected, the MES can prompt managers to conduct equipment maintenance or process adjustments.

- Settings of the MES System in Casting Production

The MES system in casting production is set up to conduct real – time metering and accounting by process. - Actual Application Effects of the MES System

Some foreign casting enterprises have used the MES system to obtain cost – difference data during production, enabling in – process cost control and demonstrating more efficient cost management:- Increasing Cost – Management Efficiency by 20%: The automatic collection and analysis of real – time data have reduced the time and errors of manual accounting.

- Reducing Energy Consumption during the Production Process by 5%: Through the dynamic monitoring of energy – consumption costs, enterprises can adjust the equipment operation state in a timely manner and reduce unnecessary energy consumption.

| Performance Indicator | Improvement Effect |

|---|---|

| Cost – management – efficiency increase | 20% |

| Production – process energy – consumption reduction | 5% |

By introducing cost – model – based software, batch – cost management, and the MES system, casting enterprises can achieve digital transformation and management change in casting costs, solve problems such as low efficiency in the existing management mode and unclear responsibilities, and achieve more accurate, flexible, and real – time cost control. In the future, with the continuous progress of Industry 4.0 technology, casting enterprises can also introduce more intelligent cost – management tools and methods, such as big – data analysis, Internet of Things monitoring, and artificial – intelligence – based decision – support, to further enhance the cost – management level of casting processes.

5. Research Conclusions

This research deeply explores the manufacturing – cost – management issues in heavy – machinery casting processes. By combining the advantages and disadvantages of the application of the standard cost method and the actual cost method in current enterprises, it analyzes the difficulties and challenges in casting – cost accounting. The following main conclusions can be drawn:

- Complexity of Casting – Process Cost Accounting: The composition of casting – process costs involves multiple links, including material – formula costs and production – process costs. These costs are diverse and dynamic, and different links affect each other, making accurate cost accounting and management very difficult.

- Limitations of the Standard Cost Method and the Actual Cost Method: The advantage of the standard cost method lies in its ease of operation and management, but its indirect – cost – allocation method makes it difficult to accurately reflect the true costs of specific parts. The actual cost method can more accurately reflect the actual production costs, but the large monthly fluctuations lead to poor cost – management stability. The application of both methods has problems of cost – accounting deviation and management difficulties.

- Potential of New Cost – Management Methods: Drawing on the experience of advanced foreign enterprises, by introducing cost – model – based software, batch – cost management, and the MES system, casting enterprises can achieve more accurate and flexible cost management. These new methods can overcome the limitations of traditional methods, improve the accuracy and real – time nature of cost accounting, and enhance the enterprise’s adaptability.

- Informatization and Intelligence: The Future Direction of Casting – Cost Management: With the help of modern information technology and intelligent – manufacturing tools, casting enterprises can achieve dynamic cost accounting and optimization during the design stage and production process. This method can not only improve cost transparency and accuracy but also enhance production efficiency and resource utilization, helping enterprises gain a greater cost advantage in the fierce market competition.

6. Conclusion

In the field of casting – process cost management, future development will mainly focus on informatization, intelligence, and green manufacturing. These trends pose new challenges and opportunities for the cost management of casting enterprises.

In the future, casting enterprises will achieve full – process information sharing and data docking. Through the comprehensive application of information systems, enterprises can conduct dynamic cost monitoring and analysis in design, production, and quality – management links, improving management efficiency. Digital – twin technology, artificial intelligence, and other technologies can help casting enterprises simulate and optimize the casting process in a virtual environment, test different material formulas, process parameters, and production conditions, and find the optimal cost – saving plan.

With the increasingly strict environmental – protection requirements, casting enterprises need to pay more attention to the efficient use and recycling of materials. By optimizing material formulas, reducing waste generation, and promoting material recycling, material costs and environmental – protection costs can be significantly reduced. The introduction of energy – saving equipment and technologies can also reduce energy consumption during the production process, as well as carbon emissions and energy – consumption costs in the casting process.

In summary, casting enterprises need to continuously innovate and improve in cost management. Future cost management will no longer be just simple accounting and control but a full – process optimization process that runs through design, production, and quality management. Only through the organic combination of informatization, intelligence, and green manufacturing can casting enterprises maintain their competitiveness in global competition and achieve the dual goals of economic benefits and sustainable development.